Fixed Rate Lending At Record Low

By lucmin on 29th March 2018

Interest rates were kept at 0.5% in March keeping the cost of borrowing low for home buyers. However, a rate rise is on the horizon. Those considering a move could save money by acting now and securing their mortgage at current low levels.

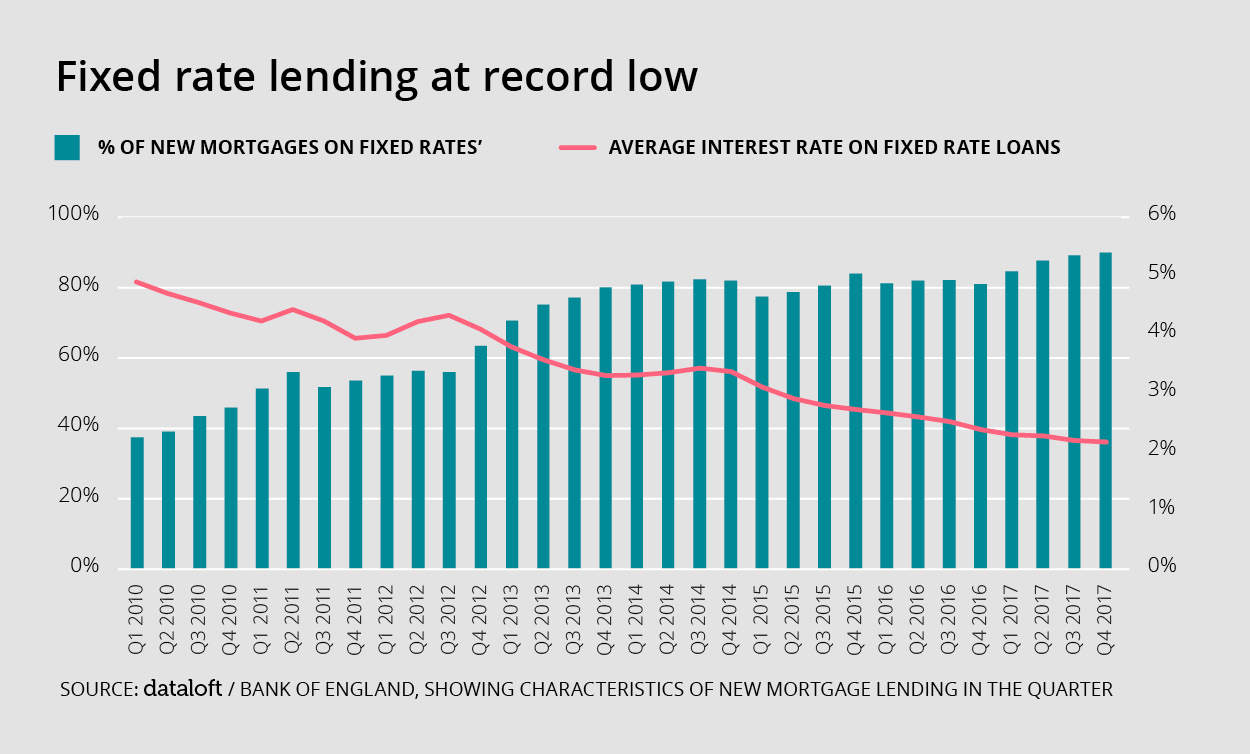

Over the last few years, borrowing on fixed rate deals has become the mortgage of choice for the majority of home owners. Indeed, over 90% of new mortgage lending (both for house purchase and remortgage) in the fourth quarter of 2018 was on fixed rate deals.

At the same time, low interest rates have kept the cost of borrowing low. At the end of 2017, the average interest rate paid by those on new fixed rate loans was 2.17%, down from 4.1% five years earlier.

After the interest rate rise at the end of 2017, further increases have been muted. While lower than expected inflation in March (down to 2.7% from 3% in February) will ease some of the pressure to raise rates in May, most commentators expect rates to have increased to 0.75% by August.